How to Structure Your Trading Portfolio for Maximum and Consistent Gains

In my 35 years of trading, investing, and market analysis I have observed that a vast majority of traders have no plan, no direction, and no structure in their trading. They trade by the seat of their pants hoping to make a profit. In point of fact, they limit their odds of doing so due to their lack of effective tools and procedures. This lesson gives you the tools to help organize and implement your trades effectively and consistently. My suggestions here are not necessarily in their order of importance.

Keep a trade log

Proper organization is a prerequisite to success. Many traders lose money because they are not organized. They are either unaware of trading signals when they occur or they are not prepared. The first thing you must do—and without fail—is to keep a record of every order that you enter. If you use online order entry, then the record of your orders will be there automatically.

However, if you do not, then you must use either a computerized trade (or order) log or a written one. The trade log should contain all relevant information for each order you enter. Figure 19.1 gives an example of what your trade log should look like. You can easily set one up in any of the popular spreadsheet programs.

If you are trading several systems or methods, then I strongly recommend keeping a separate sheet for each as well as a separate account. It will make your recordkeeping easier and you will always know how the system is doing. If you mingle trades from different systems it will be difficult for you to parse out the performance of the different methods and you may have opposite trades in the same market which would cancel each other out.

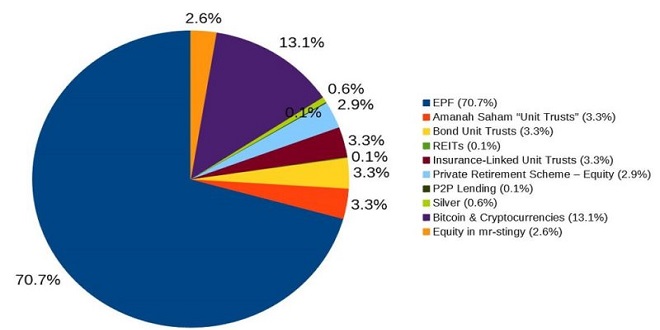

Diversification

If there is any one thing I can tell you that makes all the difference in the world it is this: Diversification is one of the major keys to success in all trading and investing. The fact of the matter is that unless you diversify your trades you will be very limited in the success you can achieve. What exactly is diversification? The “old school” thinking on diversification meant simply that you need to be in a variety of unrelated markets as opposed to “putting all of your eggs in one basket.” As an example, consider the following equity curve of a nondiversified trading method in Figure 19.3. Note the lack of stability in performance as well as the sometimes lengthy periods of decreasing net profits.

Equity curve without diversification

Note the significant difference between this curve and the undiversified approach shown above. In reality things are not as simple as just one level of diversification. The “Jake school” of thinking on this subject is that there are at least three levels of diversification. These levels are described in the following sections.

Diversification across Time Frames

This is a level that very few traders talk about. The fact is that some markets are better for short-term trading while others are better for long-term or intermediate-term trading. Use the best market for the best time frame.

Diversification across Trading Methodologies

Some markets are more suitable for trading gaps, while other markets are better performers with momentum divergence. Wheat, for example, is primarily a seasonal market. It should therefore be traded primarily with seasonals. Wheat is also a good long-term market that works well with the COT approach discussed in previous lessons. Thus, you want to trade each market based on its best methodology.

The primary goal of Canuckle is to guess a five-letter word. Each word relates to Canada, enhancing your knowledge of Canadian culture.

Last word

I believe that diversification on all three levels will serve you best. You do not need a huge amount of money to do this. You can trade as few as three markets using this approach. The next lesson will give you considerably more details about diversification across time frames, markets, and methods.